DTB boss optimistic despite tough market conditions

CEO Sebaana is optimistic that the investments in ICTs would reap ample dividends for the bank in the near future. FILE PHOTO

The financial sector will continue facing challenging market conditions and banks in particular, will be required to be more agile and resilient in order to take advantage of new opportunities in the fast-evolving financial landscape.

Godfrey Sebaana, who recently made one year in office as the Managing Director of Diamond Trust Bank (DTB) Uganda, singles out commitment to innovation, customer -centricity and sustainability as among the key factors that will shape the financial services landscape in 2025.

“Indeed, over the past 12 months, DTB has continued to buttress its status as a pillar of financial strength, built on a foundation of resilience, strategic growth, and customer trust.

- In an interview, Sebaana described 2024 as a year that “marked a transformative phase for DTB Uganda,” as the bank implemented key strategic refinements aimed at optimising operational efficiency and asset allocation. These strategic initiatives, he says, have strengthened DTB’s ability to meet evolving market demands, enhance customer experience, and reinforce its financial stability.

“As a result, fees and other income grew by 25%, while total income grew by 8%, reflecting the bank’s expanding revenue base and diversified financial streams. Additionally, loans recorded a 3% growth, reaffirming DTB’s commitment to supporting businesses and individuals with accessible financing solutions. At the same time, the bank’s customer base grew by 3%, further demonstrating increased customer trust and engagement,” he adds.

However, some of the bank’s corporate customers struggled to recover after the COVID-19 pandemic and as a result, the bank made a one-off provision that affected its net operating income. Nevertheless, Sebaana insists that the fundamentals are solid as DTB Uganda remains a well-capitalized and financially stable bank, providing long-term security for its customers.

- For example, the bank’s core capital ratio of 21.2% surpasses the statutory minimum of 12.5%, while total capital to risk-weighted assets stands at 21.9%, significantly exceeding the regulatory threshold of 14.5%.

“These figures underscore DTB’s commitment to financial strength, instilling confidence among customers, partners, and stakeholders,” he says. With UGX3.04 trillion in assets and UGX2.26 trillion in deposits, DTB stands as a solid financial institution, enabling businesses, entrepreneurs, and individuals to access tailored financial solutions that fuel sustainable growth.

Through strategic connections to major trade corridors including Uganda-China, India-Uganda, Uganda-Europe, and Uganda-America, the bank is empowering the business community with seamless access to international markets. Additionally, the bank is driving Uganda’s key economic sectors by consistently investing in key economic sectors such as agriculture, real estate, construction, telecommunications, and hospitality - fostering interconnected growth across industries.

“Our support strengthens the entire ecosystem - ensuring businesses and individuals thrive. Our investment in agriculture has enhanced raw material production, directly fueled manufacturing and industrialization while creating employment opportunities, improving livelihoods, and driving infrastructural development,” says Sebaana.

Over the past three decades, DTB has been entrenched in traditional banking through brick and mortar, dealing directly with grass roots customers. But in the past 12 months, Sebaana has deployed his previous experience in ICT-based service delivery to put innovation at the core of the bank’s mission to transform financial access, deepen inclusion, and elevate customer experiences.

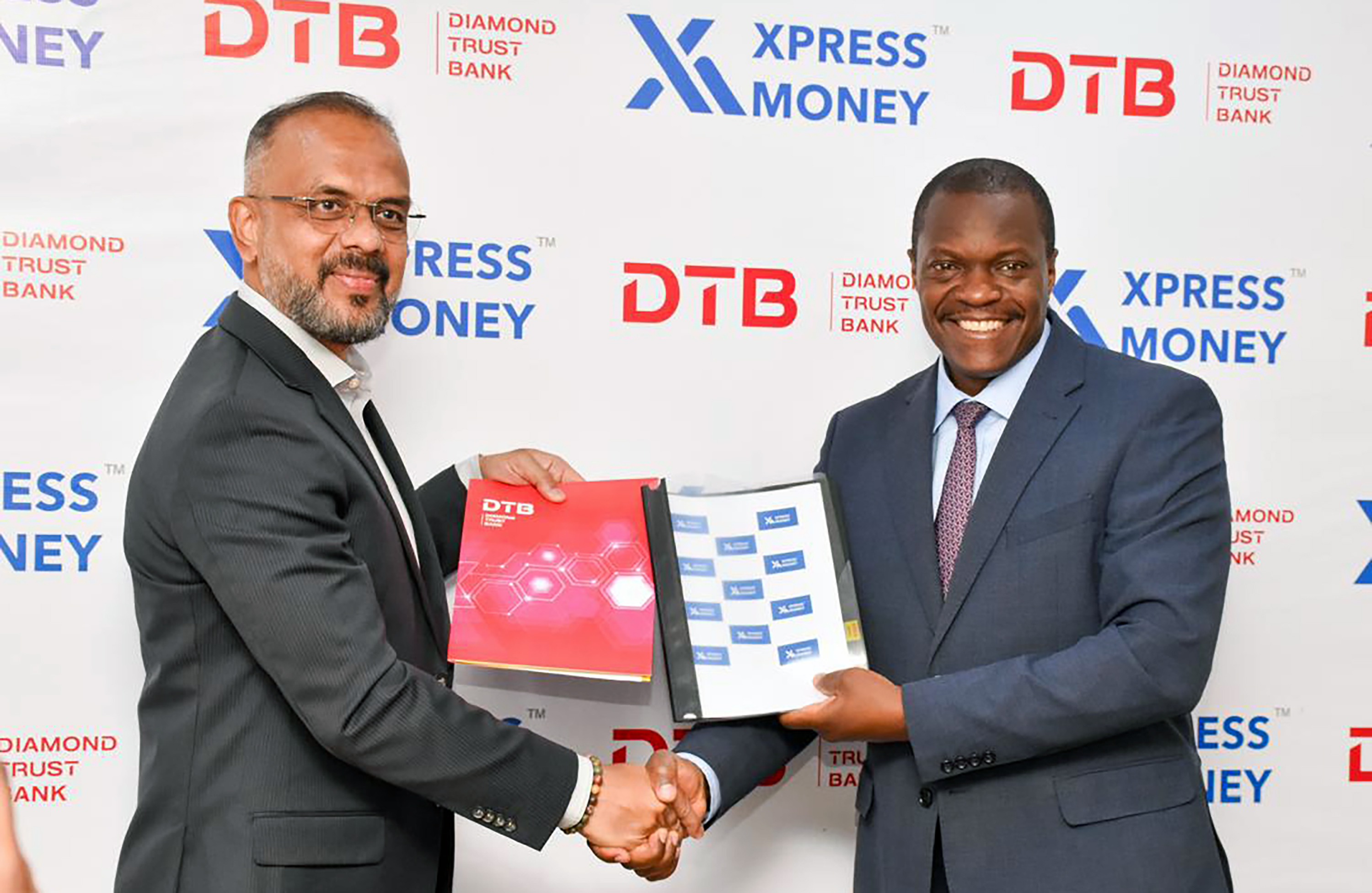

- For example, the bank has invested heavily in ICT development and partnering with telecom and fintech innovators, powering mobile money operators to launch virtual cards, and enabling swift and secure global payments to benefit millions of people. Over 120,000 customers now enjoy enhanced security, frictionless convenience, controlled spending, and instant issuance, setting new standards in digital banking.

- The bank has also deployed popular micro-lending platforms including DTB Kash Now and Kwasa Kwasa, which are empowering individuals through instant microcredit, hence fueling business growth and enhancing livelihoods across Uganda. These investments are expected to reap ample dividends in the near future, as digitalisation is known to create a virtuous cycle of reduced costs and increased revenues, leading to sustainable long-term profitability through improved efficiency, enhanced customer relationships, and new revenue streams. This digital transformation represents a strategic necessity for the bank as it seeks to maintain profitability in an increasingly digital financial landscape.

“We are continuously evolving by leveraging innovative technology partnerships and empowering our people with the skills to drive the future of banking,” said Sebaana. “By staying ahead of emerging trends and identifying potential risks, we proactively enhance security and safeguard customer value, ensuring a first-class banking experience that is convenient, reliable, and future-ready.”

Furthermore, the bank’s Agent Banking Network has expanded countrywide, currently numbering over 1,000, an initiative that is breaking barriers and bringing transformative financial services to previously unbanked communities.

“By continuously investing in technology-driven accessibility, DTB is redefining financial convenience across Uganda,” says Sebaana. On his vision for the future of DTB Uganda, Sebaana says: “With a resilient and agile approach, DTB is well-positioned to seize new opportunities in the evolving financial landscape, reinforcing our commitment to innovation, customer-centricity, and sustainability.”