Expert warns as February inflation rate doubles

A market vendor awaits customers at a market in Kampala. Weather-induced scarcity led to an increase in inflation in February. FILE PHOTO

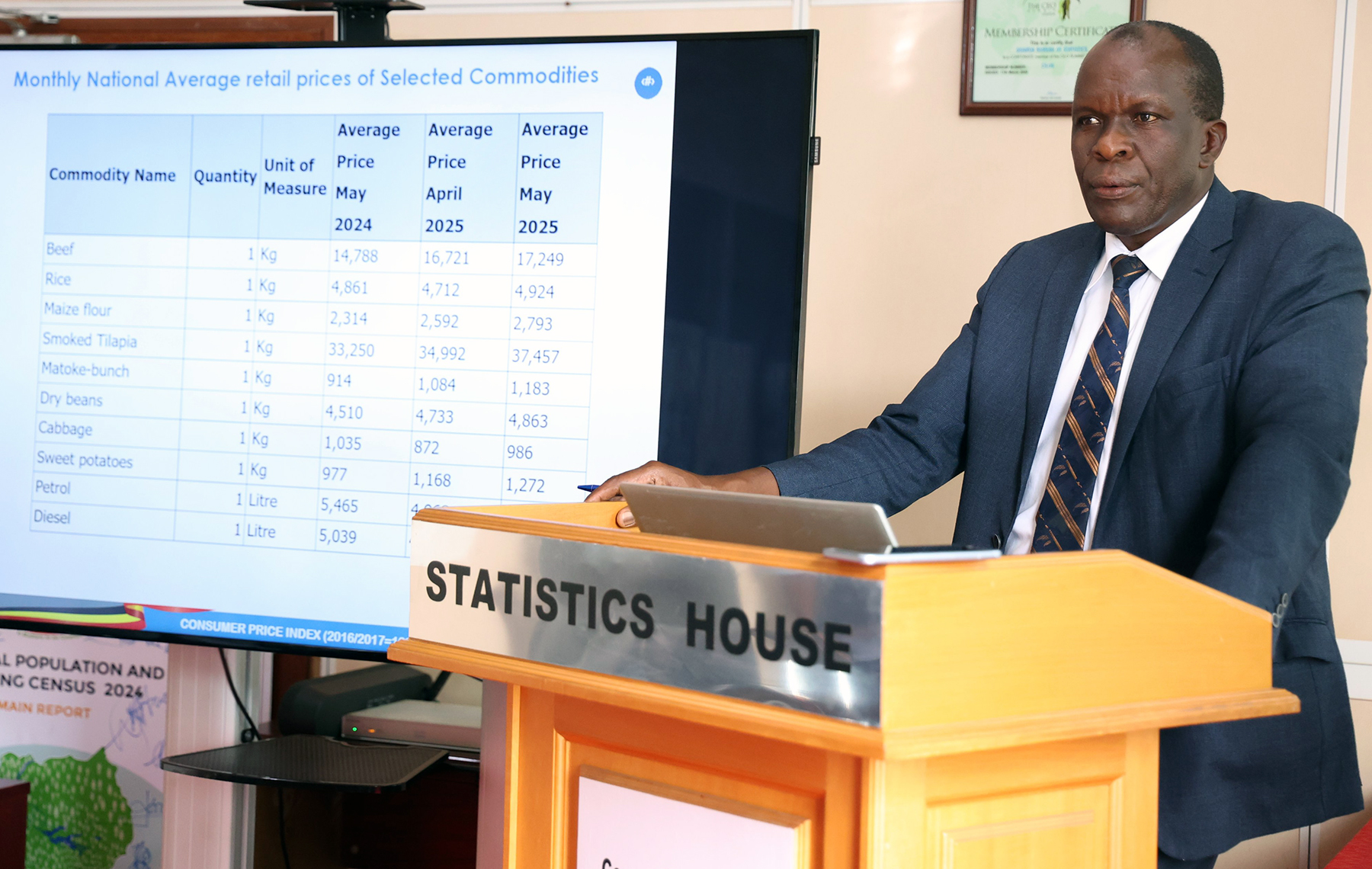

Uganda’s monthly headline inflation surged to 0.6% in February 2025, doubling from 0.3% in January, according to the latest data from the Uganda Bureau of Statistics (UBOS). The increase was primarily driven by rising prices of key food items, including tomatoes and fresh leafy vegetables.

Other notable contributors to inflation included fresh cassava, which saw its price rise from 2.5% in January to 4.1% in February, and dry beans, which increased from 0.4% in January to 2.8% in February.

In actual market prices, a kilogram of tomatoes that cost UGX2,576 in January is now selling for UGX 2,813, while green pepper prices jumped from UGX 2,267 per kilogram to UGX 3,261. Fresh tilapia, previously priced at UGX 16,098 per kilogram, now costs UGX17,231.

- Responding to the price hikes, Samuel Echoku, a microeconomic statistician at UBOS, attributed the fluctuations to market dynamics. “All is determined by demand and supply, and most of these products are seasonal. The recent increases are largely due to reduced supply following unfavorable weather conditions in major food-producing regions,” Echoku said.

The annual headline inflation for the year ending February 2025 increased to 3.7%, up from 3.6% recorded in January 2025. However, annual core inflation, which excludes volatile food and energy prices, slowed to 3.9% in February from 4.2% in January.

Additionally, the monthly inflation for the construction sector increased by 0.2% in January 2025, compared to 0.1% recorded in December 2024. This was attributed to rising costs in the construction of buildings and civil engineering works. Materials that saw significant price increases included sand, cement, aggregate, hardcore, and broken stone, while price declines were noted in iron, steel rods, and angles.

- In general terms, 2024 was good for the business sector, thanks to the relatively better macro-economic environment.

The country’s macroeconomic indicators held steady in the year with an average GDP growth of 6.6%, while the average headline inflation moderated to 3.3% in 2024, from 5.5% in 2023, and tracked below the 5.0% Central bank target.

Additionally, the local currency appreciated by 2.7% against the US Dollar in 2024, anchored by reforms in the interbank foreign exchange market, which have promoted currency stability.

Economists caution that if inflationary pressures persist in 2025, consumers may continue to experience increased costs of living, which may affect aggregate spending. Policy interventions to stabilize food production and supply chains would therefore be crucial in mitigating further price surges.

Economist Fred Muhumuza told this publication that inflation in Uganda is largely driven by structural challenges in the economy.

- “The persistent inflationary pressures are not just about external shocks but also domestic inefficiencies, such as post-harvest losses and inadequate market infrastructure. Addressing these issues requires long-term investment in value addition and improved storage facilities,” Muhumuza explained.

- With inflation trends showing fluctuations, policymakers and economists remain watchful of external and internal factors influencing Uganda’s economy. The government’s ability to manage inflation will be critical in maintaining economic stability and ensuring sustainable growth.

Last month, the Bank of Uganda (BoU) decided to maintain the Central Bank Rate (CBR) at 9.75%, saying the near-term inflation outlook was largely contained, though external uncertainties continue to pose risks to economic performance.

BoU Governor Michael Atingi-Ego explained that the Central Bank anticipated core inflation to stay within a 4%-5% range over the course of 2025, but global uncertainties continued to present a clear risk to the forecast.

Similar Posts You May Like

-

.jpeg)

DTB SCOOPS THE MOST INNOVATIVE BANCASSURANCE AGENT 2022 AWARD..

Diamond Trust Bank – DTB has been named the Most Innovative Bancassurance Agent in Uganda for the year 2022 at the prestigious Insurance Innovations Award -2022 held that the Kampala Serena Hotel. DTB was voted the most innovative Bancassurance Agent because of its innovation in the use of Digit..

-

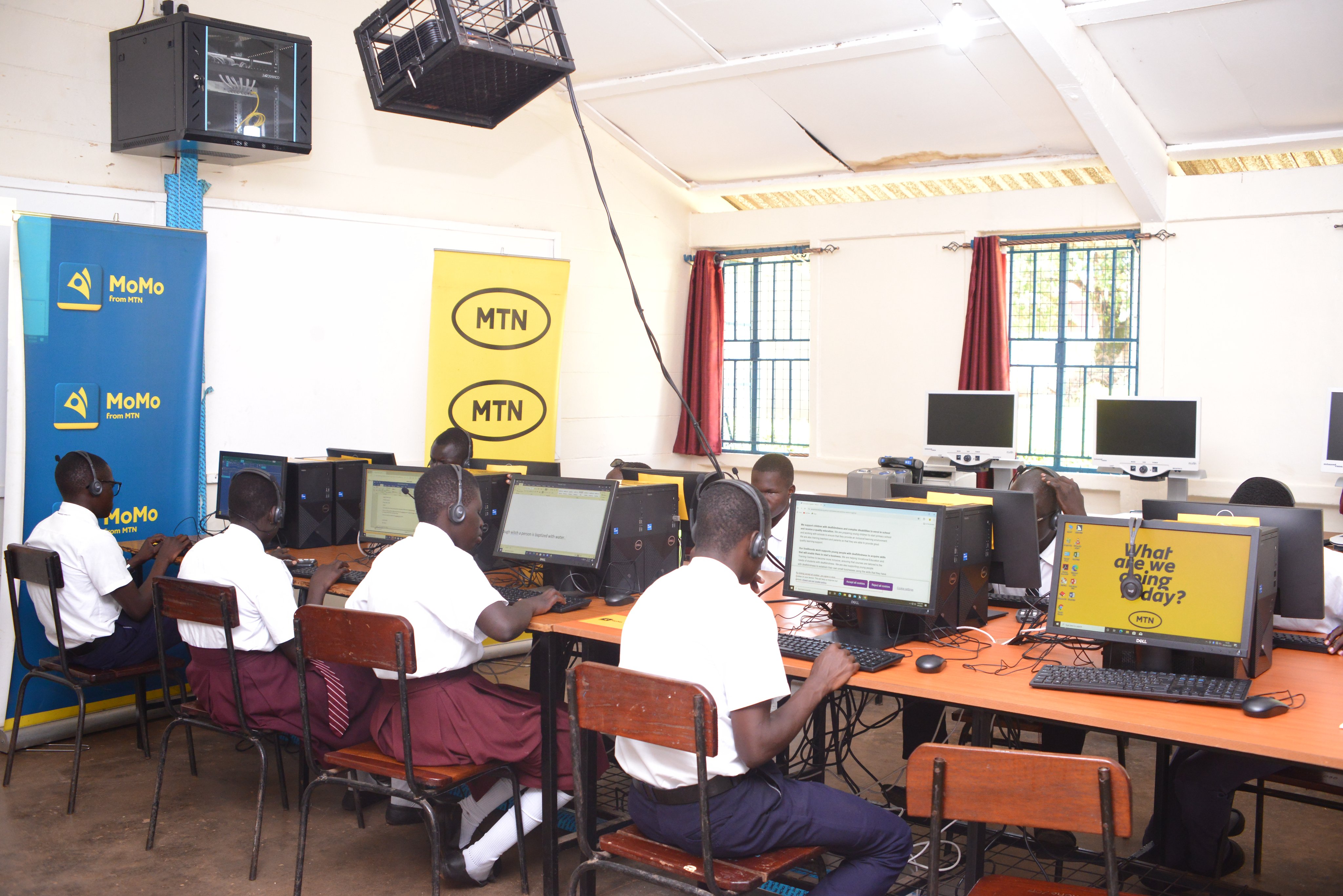

MTN Uganda delivers on promise to President Yoweri Museveni, successfully mo..

Wednesday 6th September 2023. Kampala, Uganda. MTN Uganda has fulfilled President Yoweri Museveni's call to action, rallying South African investors to explore opportunities in Uganda. This remarkable achievement follows the successful conclusion of the second leg of the Uganda-South Africa summ..

-

President Yoweri Kaguta Museveni on Use ICT to Build Our Economy..

President Yoweri Kaguta Museveni has cautioned Ugandans against using Information And Communications Technology (ICT) to promote importation of goods. President Museveni said Ugandans should use ICT to promote the buying of goods and services within Uganda or promote selling to outsiders but not vic..

-

There is a ready market, Museveni assures Foreign Investors..

President Yoweri Kaguta Museveni has wooed foreign investors to invest in Uganda, saying that the East African country has a lot of investment opportunities with a readily available market...

-

Uganda Listed Among Top Kyeyo Cash Recipients..

A new report by the World Bank has shown that Uganda is among the top ten recipients of money from nationals working abroad, commonly referred to as 'kyeyo' cash, in Sub-Saharan Africa...

-

President Museveni Takes Over Chairmanship Of G77 + China..

Uganda has assumed the chairmanship of the Group of 77 plus China (G77+China)...

-

URA tasked to sensitise traders on how Electronic Fiscal Receipting and Invo..

In January 2021, URA implemented EFRIS to tackle tax administration issues associated with business transactions and receipt issuance...

-

UBL sets up UGX20 billion cleaning facility ..

Uganda Breweries Limited, the maker of Tusker and Guinness, has commissioned a state-of-the-art effluent treatment plant, which officials said marks a significant milestone in the company's commitment to sustainability and reducing its carbon footprint...

-

Physical planners' body warns on quacks as new Council is elected..

Members of the Society of Professional Physical Planners of Uganda have elected new leaders as the government moves in to crackdown on imposters in the physical planning field...

-

URA now to deploy drones in smuggling fight..

The Uganda Revenue Authority (URA) has said they are to invest in surveillance drones at porous border points in an effort to curb the vice of smuggling. ..

-

Economic uncertainty as Uganda’s credit rating is downgraded..

Global credit rating agency Moody’s Ratings has downgraded Uganda’s long-term foreign-currency and local-currency issuer ratings to B3 from B2, a development that implies that going forward Uganda’s bonds would be less attractive to international investors and the government would have to borr..

-

Address drivers of rising national debt - experts..

Uganda’s debt risks are becoming more pronounced both in the short to medium term, largely attributed to poor debt utilization as one of the key causes of the nation's mounting public debt stock...

-

Tomatoes, vegetables push inflation to 3.6%..

The escalating prices of tomatoes and fresh vegetables have been the primary drivers behind the rise in headline inflation rate in May. ..

-

BoU maintains CBR at 10.25% as inflationary pressures persist..

Bank of Uganda has kept its key rate unchanged at 10.25% in June unlike in the previous month when it was raised from 10%, which was prompted by rising inflation and significant depreciation of the Ugandan shilling against major currencies...

-

Uganda acquires $500m loan from S.Korea..

Uganda has signed an agreement with South Korea for a $500 million loan to help finance infrastructure building in the east African country, Uganda's finance ministry has said...

-

Survey shows private sector improvement in May..

The month of May saw a further improvement in the private sector’s performance, according the Stanbic Bank Purchasing Managers’ Index (PMI). ..

-

Stop budgeting for corruption, CSOs tell MPs..

In a stirring call to action, Civil Society Organizations (CSOs) want Members of Parliament to eliminate budget allocations that enable corruption. ..

-

Museveni sets up outfit to fight URA corruption..

President Yoweri Museveni has set up a new unit at State House, aimed at keeping an eye on Uganda Revenue Authority and curb corruption in the tax administration system...

-

EU, Enabel boost refugees with vocational skills..

More than 5,000 youth in refugee communities in the West Nile Region have been passed out after receiving vocational skills aimed at boosting their self-employment opportunities and household incomes. ..

-

Planning Authority warns on surging population..

The National Planning Authority has expressed concern about Uganda’s population, which has surged by 11.3 million since the last census...

-

Uganda boosts diplomatic, trade ties with France..

The Deputy Speaker of Parliament, Thomas Tayebwa, has hailed the cooperation between Uganda and France in the areas of trade, investment and diplomatic relations as a formidable uniting factor that ought to be fostered for further growth...

-

IMF projects modest global growth amid persistent inflation..

The International Monetary Fund (IMF) has projected modest global economic growth over the next two years, driven by various regional dynamics, but cautioned about numerous risks that could derail this path. ..

-

Optimism as COMESA-EAC-SADC free trade area starts..

The COMESA-EAC-SADC Tripartite Free Trade Area (TFTA) Agreement officially came into force following ratification by the requisite number of member States. ..

-

Embassy of Norway to officially close next week..

Ugandans are set to feel the pinch as of lost jobs and business services as the Norwegian Embassy in Kampala officially closes its doors next week on July 31. ..

-

Concern over fewer girls in vocational institutions..

The low enrolment and completion rates for girls in Uganda’s Technical Vocational Education and Training (TVET) programmes should be a serious concern for policy makers and implementers, according to a new report. ..

-

Uganda nets UGX 80 billion from visa fees..

The Directorate of Citizenship and Immigration Control (DCIC) has reported a substantial increase in revenue from visa visa fees for the 2023/2024 fiscal year, totalling over UGX80 billion, up from UGX45 billion in the previous year. ..

-

Inflation hits highest level in 12 months..

High cabbage, fish and Irish potatoes prices were the primary drivers of the 4% annual inflation in July, the Uganda Bureau of Statistics (UBOS) has indicated as per the July Consumer Price Index (CPI). ..

-

Optimism as Central Bank cuts key rate to 10%..

The Bank of Uganda (BoU) has slashed the Central Bank Rate (CBR) by 25 basis points to 10%, a development that experts say would have significant implications for the banking sector and broader economic landscape in the country...

-

UBOS reports rise in August inflation..

The Uganda Bureau of Statistics (UBOS) has released the Consumer Price Indices and Inflation report for August 2024, highlighting a slight increase in monthly inflation and a noticeable rise in the prices of certain commodities, particularly mangoes and oranges. ..

-

Gov’t arrears threaten URA performance..

Uganda's revenue collection is facing a serious threat from the growing backlog of government arrears, which is straining the Uganda Revenue Authority’s (URA) ability to meet its targets. ..

-

Amongi drops Dr. Kimbowa from NSSF Board..

Gender, Labour and Social Development Minister Betty Amongi has appointed David Ogong as the new chairperson of the new Board of Directors for the National Social Security Fund (NSSF), replacing Peter Kimbowa whose contract was not renewed...

-

2025/26 budget strategy to focus on four pivotal sectors ..

The Government is outlining an ambitious strategy for the 2025/2026 fiscal year, aimed at steering the country towards a fully monetized and formalized economy...

-

URA exceeds August target by UGX27 billion ..

The Uganda Revenue Authority (URA) has reported an impressive performance for August, with revenue collections surpassing the set target. ..

-

IMF cautions Ugandan banks over treasury bonds..

In a new report, the International Monetary Fund (IMF) has warned commercial banks against overreliance on Government securities saying it raises serious financial concerns for the country’s economy...

-

Anxiety as donor aid taps shrink further..

During the recent presentation of the Budget Strategy for the Financial Year 2025/2026, officials from the Ministry of Finance, Planning and Economic Development warned that dwindling external financing down by approximately 30% from UGX 4.4 trillion (about $1.2 billion) in 2022 to an estimated UGX3..

-

EADB launches UGX68 bn fund for Ugandan SMEs..

The East African Development Bank (EADB), the region’s leading development financial institution, has launched a new $15 million (about UGX68 billion) fund to support the growth of 1,500 rural-based Small and Medium Enterprises (SMEs) in Uganda. ..

-

Charcoal hikes September inflation by 0.2%..

Uganda experienced a notable increase in inflation in September 2024, as headline inflation rate soared by 0.2%, consistent with the previous month. ..

-

EADB gets positive credit ratings review..

The East African Development Bank's (EADB), the region’s premier development financial institution, has received positive credit results from a review of its credit ratings, raising hopes that borrowers would continue to borrow at more favourable interest rates...

-

BoU slashes key rate to 9.75% from 10.25%..

The Monetary Policy Committee (MPC) of the Bank of Uganda has announced a significant reduction in the Central Bank Rate (CBR), lowering it by 25 basis points to 9.75%. ..

-

Optimism as national economy registers 6.6% growth..

Optimism as national economy registers 6.6% growth..

-

Uganda gets positive IMF growth projection..

The International Monetary Fund (IMF) has painted a positive picture of Uganda’s economic growth prospects, posting a 5.9% growth projection, according to the latest World Economic Outlook report, which is above the average of 4.2% for Sub-Saharan Africa...

-

Optimism as Uganda nears full BRICS nod..

Uganda has become one of the two African countries that have been admitted into the BRICS alliance in the category of ‘partner states.’..

-

US election: Africa hoping for the better..

Voters in the United States today go to the polls to choose the 47th president of what is the world’s largest economic and military superpower, in an election that is not only tight in the US, but is also being closely watched around the world, including Africa...

-

Likely implications of Trump return for Africa ..

Across Africa, Donald Trump’s forth-coming second term holds various implications for the continent and its development agenda. The United States remains an important partner in Africa’s growth. Through initiatives like the African Growth and Opportunity Act (AGOA) and the Millennium Challenge C..

-

Uganda among top 20 FDI destinations in 2024 ..

Uganda has been named among the top 20 investment destinations on the African continent in 2024...

-

Exports slump as coffee crisis bites..

A new report by the Ministry of Finance, Planning and Economic Development has indicated that Uganda’s export earnings dropped by UGX 410.4 billion in September. ..

-

Civil society welcomes nationwide school-feeding plan..

Civil society organisations (CSOs) have welcomed the setting up of a national multisectoral working group to guide the implementation of the national school feeding initiative next year. ..

-

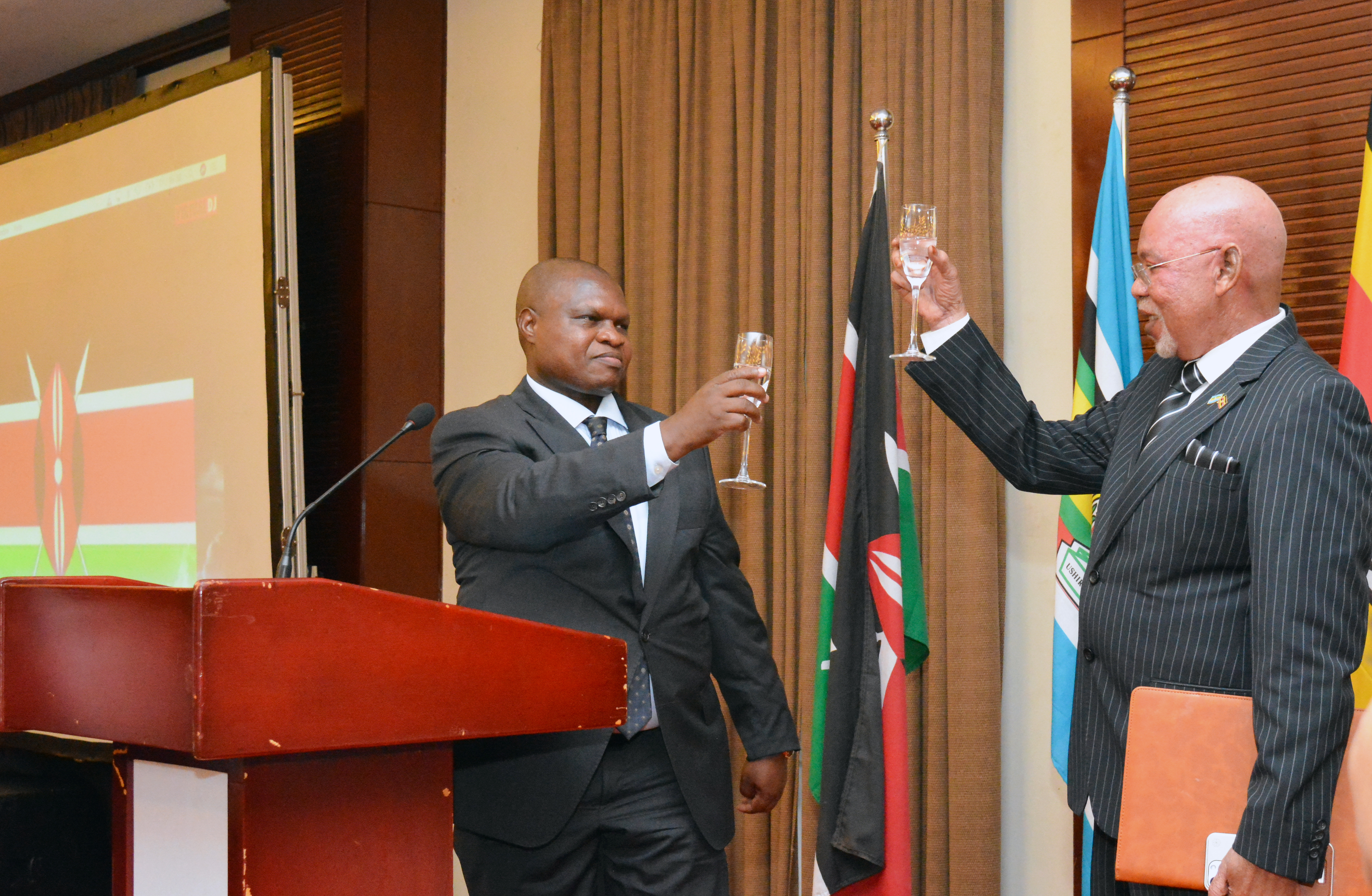

Kenyan envoy hails economic diplomacy, cooperation..

The Kenyan High Commissioner to Uganda, Joash Maangi, has acknowledged the enduring "brotherhood" between Kenya and Uganda, which he said has significantly contributed to mutual progress. ..

-

Optimism as October exports surge to UGX2.7 trillion ..

Uganda’s export earnings surged to US$744.86 million (approximately UGX2.7 trillion) in October 2024, marking a 9% increase from US$682.69 million (UGX2.47 trillion) in September. ..

-

Uganda now officially BRICS partner country ..

BRICS, the Global South-led forum for economic cooperation, continues to grow in influence, as it seeks to de-dollarize and transform the international monetary and financial system...

-

UGX20 Billion squandered in pension scam ..

The Auditor General’s report for the year ending 2024 has unveiled alarming financial irregularities in the management of pension and gratuity benefits, revealing over UGX 20 billion in overpayments to beneficiaries. ..

-

What President Museveni said in Abu Dhabi..

President Museveni has been in Abu Dhabi for the Sustainability Week 2025. This is an abridged version of his speech at the event...

-

Museveni woos Arab Emirates investors to Uganda..

President Yoweri Kaguta Museveni has extended a call to global investors, particularly those in the United Arab Emirates (UAE), to seize lucrative opportunities in Uganda by investing in the country. ..

-

Debt Crisis: Experts want urgent reforms ..

Standing at UG 96.1 trillion ($25.3 billion) as of June 2023, Uganda’s debt burden is approximately 52% of the country’s GDP. This debt comprises UGX 44.6 trillion in domestic debt and UGX 52.8 trillion in foreign debt. In his latest annual report, the Auditor General highlights the growing chal..

-

Central Bank maintains key rate at 9.75%..

The Central Bank Rate (CBR) for February will remain at the same rate of 9.75%, which has been in place since the end of last year, according to the Bank of Uganda. ..

-

URA sees 10% reduction in tax objection cases..

The Uganda Revenue Authority (URA) has reported a 10% decline in tax objections filed during the 2023/2024 financial year - reducing from 45% to 35%. ..

-

New URSB initiative to improve business survival..

The Uganda Registration Services Bureau (URSB) has launched an initiative whose objective is to equip entrepreneurs and corporate entities with essential skills in financial literacy, corporate governance, and business management to enhance business sustainability...

-

GROW: Low funds uptake irks Auditor General..

The Auditor General has raised concerns about the Generating Growth Opportunities and Productivity for Women Enterprises (GROW) project, a key initiative aimed at empowering women entrepreneurs, which he says has recorded a low uptake of funds. ..

-

Coffee, minerals spur Uganda’s exports in December ..

Uganda’s export sector recorded impressive growth in December 2024, with merchandise exports increasing by about 14% according to the January 2025 Performance of the Economy Report released by the Ministry of Finance, Planning and Economic Development...

-

Business sector rebounds in February - Stanbic report..

Uganda's private sector showed signs of recovery in February, after a temporary slowdown at the start of the year, the Stanbic Bank Purchasing Managers’ Index (PMI) has shown...

-

France offers UGX 340 billion for clean water..

Uganda has secured €85 million (about UGX 340 billion) from the Government of France to enhance water infrastructure and urban development in the Greater Kampala Metropolitan Area (GKMA)...

-

Money laundering, financial crime worries regional States..

In a resounding declaration aimed at securing regional financial stability, the Government of Uganda has pledged support for initiatives battling money laundering and terrorism financing, emphasizing that the stakes are far higher than mere financial compliance. ..

-

Government releases UGX19.79 trillion for Q4..

Government of Uganda has strategically released UGX 19.79 trillion for the fourth and final quarter (April-June 2025) of the Financial Year 2024/25. The capital injection represents about 25.6% of the revised national budget...

-

Central bank maintains key rate at 9.75% ..

The Monetary Policy Committee of the Bank of Uganda has decided to keep the Central Bank interest rate at 9.75% for May. ..

-

May inflation up to 3.8% as food prices surge..

Uganda’s Annual Headline Inflation rose to 3.8% in the 12 months ending May 2025, up slightly from 3.5% in April 2025, according to the latest Consumer Price Index (CPI) report by the Uganda Bureau of Statistics (UBOS). ..

-

Ensure fiscal discipline, civil society tells Government ..

As Finance Minister Matia Kasaija prepares to unveil Uganda’s national budget on June 12, civil society organizations (CSOs) are intensifying calls for greater fiscal discipline, transparency, and improved service delivery warning that without these, public investments will fail to meet the countr..

-

Uganda’s exports revenues soar to $11.8 billion..

Uganda’s export sector has registered remarkable growth, with total exports of goods and services reaching USD 11.8 billion (UGX 45.4 trillion) in the 12 months to March 2025, up from USD 9.56 billion (UGX 36.7 trillion) during the same period in 2024, Finance Minister Matia Kasaija has said. ..

-

Will UGX72.4 trillion budget spur sustainable growth?..

Finance Minister Matia Kasaija has presented the national budget amounting to UGX 72.4 trillion (approximately USD18.8 billion), underscoring the government's strategic focus on transforming the economy, fostering wealth creation, and enhancing the livelihoods of its citizens...

-

UGX4.43 trillion raised from treasury bonds in May..

Uganda’s government raised more than UGX4.43 trillion from the sale of government securities in May 2025, according to the Performance of the Economy Report for May 2025 released by the Ministry of Finance, Planning and Economic Development. ..

-

EAC in crisis over members’ UGX220 bn arrears..

A financial crisis is threatening to cripple the East African Community (EAC) as member states collectively owe a staggering $58 million (UGX 220 billion) in unpaid annual contributions as of March 2025. ..

Most Recent

Put people at centre of digital roadmap - MTN ..

Uganda’s Digital Transformation Roadmap, which envisions a future where digital tools drive econom..

PostBank's Wendi hits UGX 1 tn in PDM disburse..

Wendi, a digital wallet developed by PostBank Uganda, has processed more than UGX 1 trillion in cash..

MTN MoMo ventures into life insurance with San..

MTN Mobile Money Uganda Limited has unveiled Cover by MoMo, a mobile-based insurance platform design..

August coffee exports set new 838,000 bags re..

Uganda’s coffee industry soared to new heights in August 2024, earning UGX820 billion from exports..

KK Security rebrands to GardaWorld Security..

KK Security has officially transitioned to GardaWorld Security in Uganda, marking a significant shif..

Digital skills for youth must be an urgent pri..

"I can’t believe this is happening! We have computers now!" exclaimed Aisha Nakalema, a student at..

MTN offers girls’ skilling initiative UGX270..

Smart Girls Foundation, a Kasangati-based girls’ skilling initiative, is set to receive an additio..

- Top Story

Manufacturers task Gov't, banks on high intere..

The Government wants commercial banks to lower the interest rates they charge manufacturers so as to..

- Top Story

MTN scoops fastest internet award..

Ookla, the global leader in internet testing and analysis, has announced MTN Uganda as the Fastest M..

BoU to review StanChart’s exit plan from Uga..

The Bank of Uganda (BoU) is set to assess a proposal from Standard Chartered Bank Uganda regarding t..

Anxiety as donor aid taps shrink further..

During the recent presentation of the Budget Strategy for the Financial Year 2025/2026, officials fr..

Kidepo National Park to get posh airport, hote..

The Government of Uganda has reached an agreement with the Sharjah Chamber of Commerce and Industry,..

Popular Links

Put people at centre of digital roadmap - MTN ..

Uganda’s Digital Transformation Roadmap, which envisions a future where digital tools drive econom..

PostBank's Wendi hits UGX 1 tn in PDM disburse..

Wendi, a digital wallet developed by PostBank Uganda, has processed more than UGX 1 trillion in cash..

MTN MoMo ventures into life insurance with San..

MTN Mobile Money Uganda Limited has unveiled Cover by MoMo, a mobile-based insurance platform design..

Uganda among top 20 FDI destinations in 2024 ..

Uganda has been named among the top 20 investment destinations on the African continent in 2024...

Uganda, South Sudan moot joint dam projects..

Pal Mai Deng, the South Sudanese minister of Water Resources and Irrigation, has submitted a memo to..

Uganda, 15 countries set for electricity trade..

The Eastern Africa Power Pool (EAPP), an intergovernmental organization that was established to prom..

WTO boss Ngozi Okonjo-Iweala given second term..

The General Council of the World Trade Organization (WTO) has agreed by consensus to reappoint Dr. N..

Likely implications of Trump return for Africa..

Across Africa, Donald Trump’s forth-coming second term holds various implications for the continen..

Optimism as Uganda nears full BRICS nod..

Uganda has become one of the two African countries that have been admitted into the BRICS alliance i..