Will UGX72.4 trillion budget spur sustainable growth?

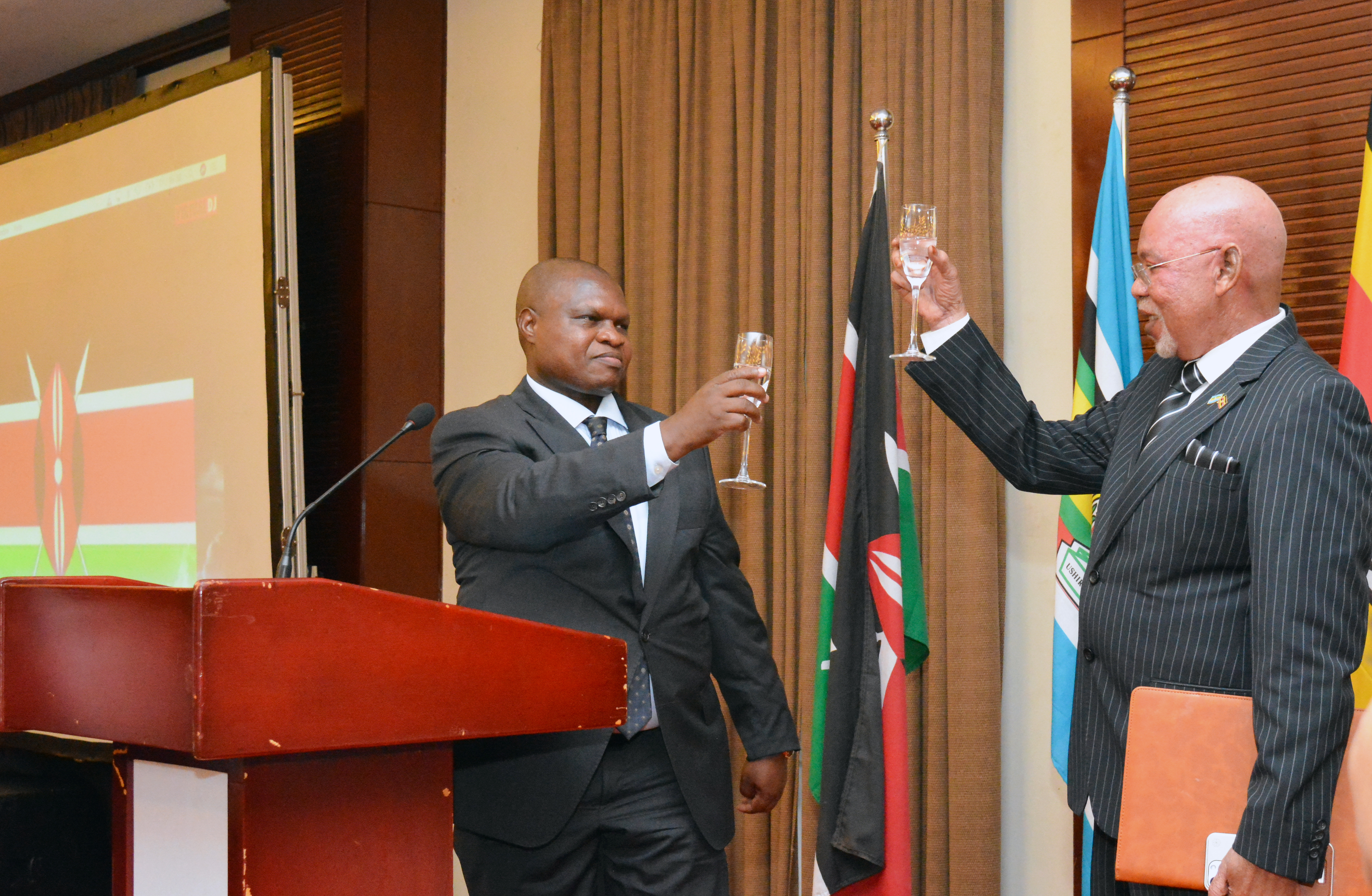

Ramadhan Ggoobi (L), the Permanent Secretary and Secretary to the Treasury, consults with Bank of Uganda Deputy Governor Augustus Nuwagaba, during the presentation of the National Budget in Kampala on June 12.

Finance Minister Matia Kasaija has presented the national budget amounting to UGX 72.4 trillion (approximately USD18.8 billion), underscoring the government's strategic focus on transforming the economy, fostering wealth creation, and enhancing the livelihoods of its citizens.

The comprehensive fiscal plan, unveiled at Kololo Independence Grounds, is anchored on the theme ‘Full Monetization of the Economy through Commercial Agriculture, Industrialization, Expanding and Broadening Services, Digital Transformation, and Market Access,’ shows that the economy is projected to achieve a robust growth rate of 7% in FY 2025/26, elevating the Gross Domestic Product (GDP) to UGX 254.2 trillion (USD 66.1 billion).

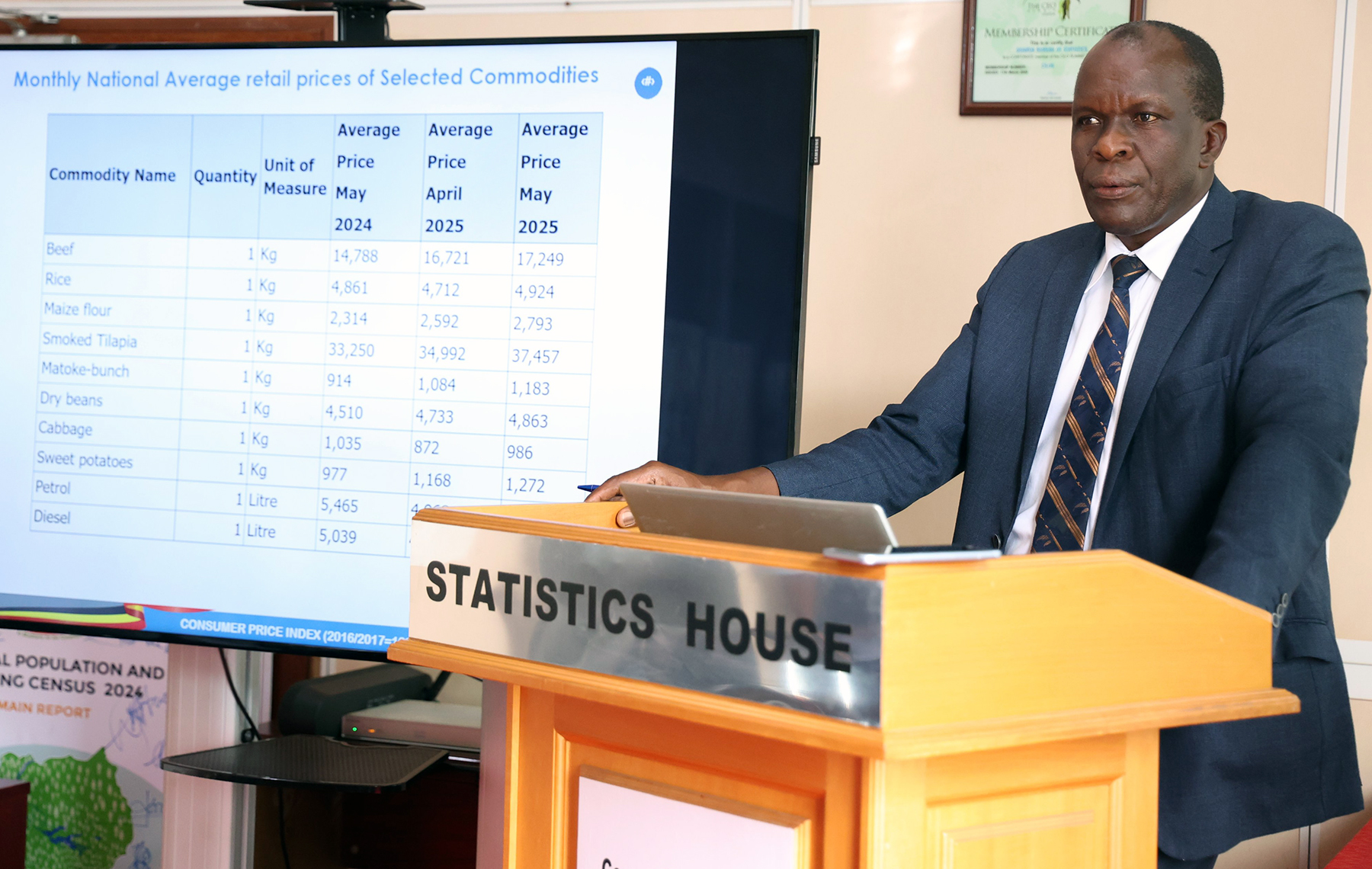

Per capita income is anticipated to increase to USD 1,324 from USD 1,263 in the preceding year. Inflation, which stood at 3.4% in May 2025 is projected to remain below the Central bank target in the new financial year.

- Kasaija attributed this positive economic trajectory to sustained government investments in critical infrastructure, the prevailing peace and stability, and the strategic implementation of science-led innovation and wealth creation initiatives.

Key programs such as the Parish Development Model (PDM), Emyooga, and the INVITE and GROW projects have been instrumental in driving economic progress at the grassroots level.

The FY 2025/26 budget will be primarily financed through domestic revenue collection, projected at UGX 37.2 trillion. This comprises UGX 33.9 trillion from tax sources and UGX 3.3 trillion from non-tax sources.

- The remaining financing gap will be bridged through a combination of domestic borrowing (UGX 11.4 trillion), external loans and grants (UGX 13.4 trillion), and the refinancing of domestic debt (UGX 10 trillion).

To bolster revenue mobilization, the Uganda Revenue Authority (URA) is set to intensify efforts in tax base expansion, optimize digital enforcement tools including the Electronic Fiscal Receipting and Invoicing Solution (EFRIS), and mitigate tax leakages through targeted legal reforms.

The budget outlines allocations across various expenditure categories notable of which are domestic debt refinancing and interest payments, which would swallow more than UGX21.3 trillion, more than half of the projected revenue collection of UGX37 trillion.

The budget prioritizes key sectors deemed critical for socio-economic development:

1. Health: UGX 721 billion is earmarked for enhancing healthcare services, including the procurement of essential medicines, immunization programs, and the upgrading of health infrastructure. Significant progress has been made with the commissioning of new blood banks and oxygen plants, alongside the expansion of specialized facilities for cancer and cardiac care.

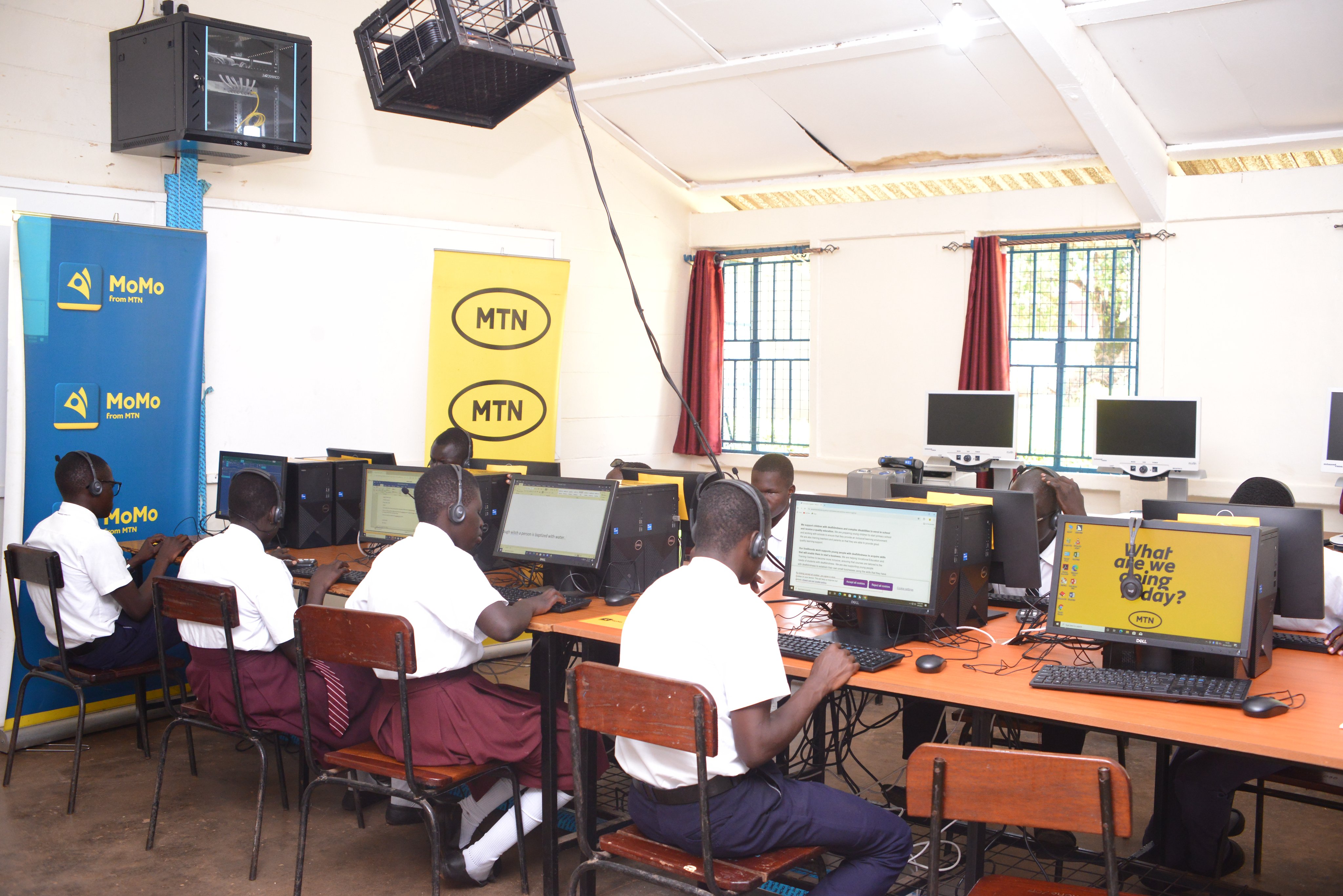

- 2. Education: A substantial UGX 5.04 trillion is allocated to support Universal Primary and Secondary Education, facilitate the rehabilitation of traditional schools, recruit additional teachers, ensure adequate textbook supply, and operationalize Bunyoro and Busoga universities.

- 3. Social Protection: Over UGX 811 billion will be channeled towards supporting elderly persons under the Social Assistance Grants for Empowerment (SAGE) program, alongside significant investments in youth and women entrepreneurship initiatives and support for persons with disabilities.

4. Science, Technology, and Innovation: The government continues to champion the biotechnology and pharmaceutical sector. Notable progress includes continued support to Dei BioPharma in Matugga, which has commenced local medicine manufacturing, with over UGX 724 billion invested in the facility to date.

5. Infrastructure: Sustained investment in road connectivity and electricity coverage has yielded significant results, with electricity access now reaching 57% of Ugandans, a substantial increase from 11% in 2010.

The budget introduces new tax policy reforms anticipated to generate an additional UGX 538.6 billion. These reforms aim to streamline tax legislation by removing ambiguous provisions, enhancing digital compliance enforcement, and rationalizing tax exemptions to align with industrial policy objectives.

.jpeg)